Renters Insurance in and around Lewisburg

Lewisburg renters, State Farm has insurance for you, too

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

No matter what you're considering as you rent a home - utilities, number of bathrooms, number of bedrooms, house or townhome - getting the right insurance can be necessary in the event of the unexpected.

Lewisburg renters, State Farm has insurance for you, too

Renters insurance can help protect your belongings

Safeguard Your Personal Assets

The unpredictable happens. Unfortunately, the valuables in your rented townhome, such as a TV, a set of favorite books and a stereo, aren't immune to theft or abrupt water damage. Your good neighbor, agent Megan Dugan, is dedicated to helping you understand your coverage options and find the right insurance options to insure your precious valuables.

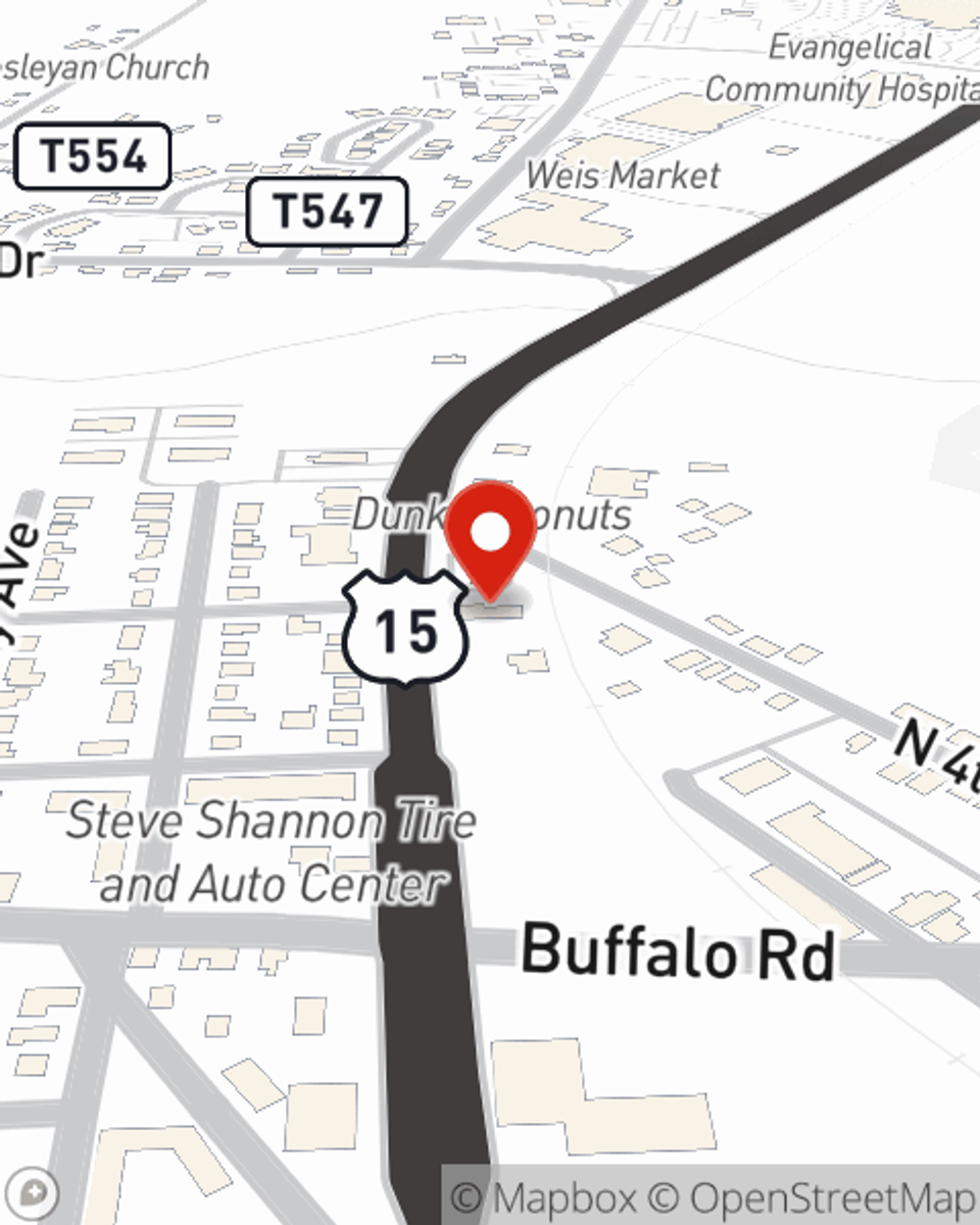

Renters of Lewisburg, State Farm is here for all your insurance needs. Visit agent Megan Dugan's office to learn more about choosing the right policy for your rented apartment.

Have More Questions About Renters Insurance?

Call Megan at (570) 524-2884 or visit our FAQ page.

Simple Insights®

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.

Is renters insurance required?

Is renters insurance required?

Renters insurance protects more than your belongings in the event of a loss. Learn about what renters insurance covers and how it can help you.

Megan Dugan

State Farm® Insurance AgentSimple Insights®

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.

Is renters insurance required?

Is renters insurance required?

Renters insurance protects more than your belongings in the event of a loss. Learn about what renters insurance covers and how it can help you.